About Vittashree Foundation

Who we are

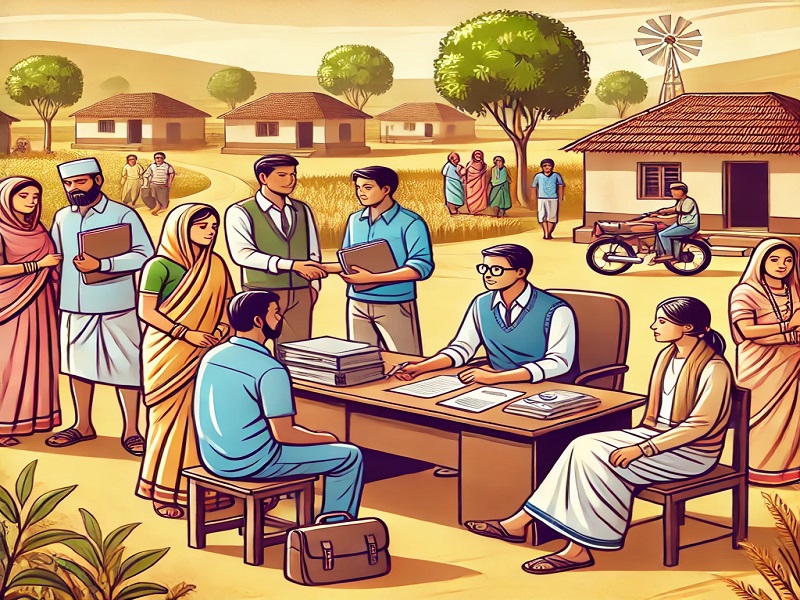

Vittashree Foundation is a registered Section 8 company, incorporated on 23rd January 2025, under the Companies Act, 2013 and approved by the Ministry of Corporate Affairs. The organization is committed to social welfare, education, healthcare, financial inclusion, and community development.

- This company is there to provide support to develop your growth.

- Vittashree Foundation focus is on empowering individuals through skill development.

- The Corporate Identity Number (CIN) of the company is U88900UP2025NPL215401.

As a non-profit entity, Vittashree Foundation is dedicated to fostering socioeconomic development and self-reliance among marginalized communities, particularly in rural and semi-urban areas. Our focus is on empowering individuals through skill development, livelihood opportunities, and entrepreneurial training, enabling them to break free from poverty and achieve sustainable growth.

Read MoreIn a group loan, each member of the group receives an individual loan.

In a group loan, each member of the group receives an individual loan, usually an equal portion of the amount stated on the loan page.

-

The group is there to provide support to its members and also provides a system of peer pressure in repayment of their loans. - In a group loan, each member of the group receives an individual loan..

- Organizations can leverage the local knowledge of individuals to select good borrowers.

Group loans are a powerful innovation in microfinance because they are often less expensive for partners to manage in terms of time and resources. Organizations can leverage the local knowledge of individuals to select good borrowers, disburse many loans at once, and collect repayments more easily.

Personal loan is an amount of money you borrow to use for a variety of purposes.

A personal loan is an amount of money you borrow to use for a variety of purposes. For instance, you may use a personal loan to consolidate debt, pay for home renovations, or plan a dream wedding.

Generally, you can use a personal loan for any expense. But some personal loan lenders restrict how you can use a personal loan.

- Personal loans are loans that can cover a number of personal expenses.

- You can find personal loans through banks, credit unions, and online lenders.

- Personal loans can be secured, meaning you need collateral to borrow money.

- Personal loans can vary greatly when it comes to their interest rates, fees, amounts, and repayment terms.

Gold is traditionally one of the most popular investment options in India

Gold loans are issued to customers after evaluating the quantity and quality of gold in the items pledged. Corporate entities can also take out secured lending by pledging the company's assets, including the company itself. The interest rates for secured loans are usually lower than those of unsecured loans.

- The interest provides an incentive for the lender to engage in the loan.

- In a legal loan, each of these obligations and restrictions is enforced by contract.

- Gold loans are issued to customers after evaluating the quantity and quality of gold in the items pledged.

The loan amount provided is a certain percentage of the gold, typically upto 80%, based on the current market value and quality of gold.

A Loan Against Property (LAP) lets you tap into your property's value

A Loan Against Property (LAP) lets you tap into your property's value by using it as collateral to secure funds. With benefits like low-interest rates and flexible repayment options, LAP can be a suitable financial solution.

Get up to 65% of the value of your property as a loan to fund planned needs – investment in business, home renovation, purchase of property, wedding in the family, children’s education and so on.

- The application process involves submitting necessary documents.

- Having your property evaluated and receiving approval from the lender.

- Loan Against Property is a secured loan product that can be useful for both salaried individuals as well as businesses. The loan gets sanctioned once you mortgage your residential or commercial property.

Call To Action

Contact in office time for any enquiry related to our company.